- A Conversation with Accenture Industry X: Ahead of the Board’s Manufacturing Symposium: Maintaining Ontario's Global Edge, we spoke with Sheri Williams and Prasad Satyavolu from Accenture Industry X about how digital transformation can drive productivity improvements.

- Industry X’s Impact: Accenture’s Industry X enables manufacturers to break down silos and integrate advanced technologies, driving agility and efficiency.

- Lessons from BlackBerry: An example of what can happen if we do not look to the future, and embrace emerging technologies and consumer demands.

- Urgency for Canada: To regain competitiveness, Canada must rapidly adopt digital tools and invest in workforce skills.

As Canada’s manufacturing sector grapples with stagnation, our upcoming Manufacturing Symposium: Maintaining Ontario's Global Edge will bring together industry leaders to explore solutions. Ahead of the event, we spoke with Sheri Williams, Managing Director at Accenture Industry X, and Prasad Satyavolu, North America Digital Manufacturing Lead at Accenture Industry X. They shared insights on how digital transformation, workforce development, and the offshoring of the semiconductor industry could shape the future of Canadian manufacturing.

Thank you both for joining us ahead of our symposium. Let’s start with the big picture—why is Canada’s manufacturing sector struggling to keep pace?

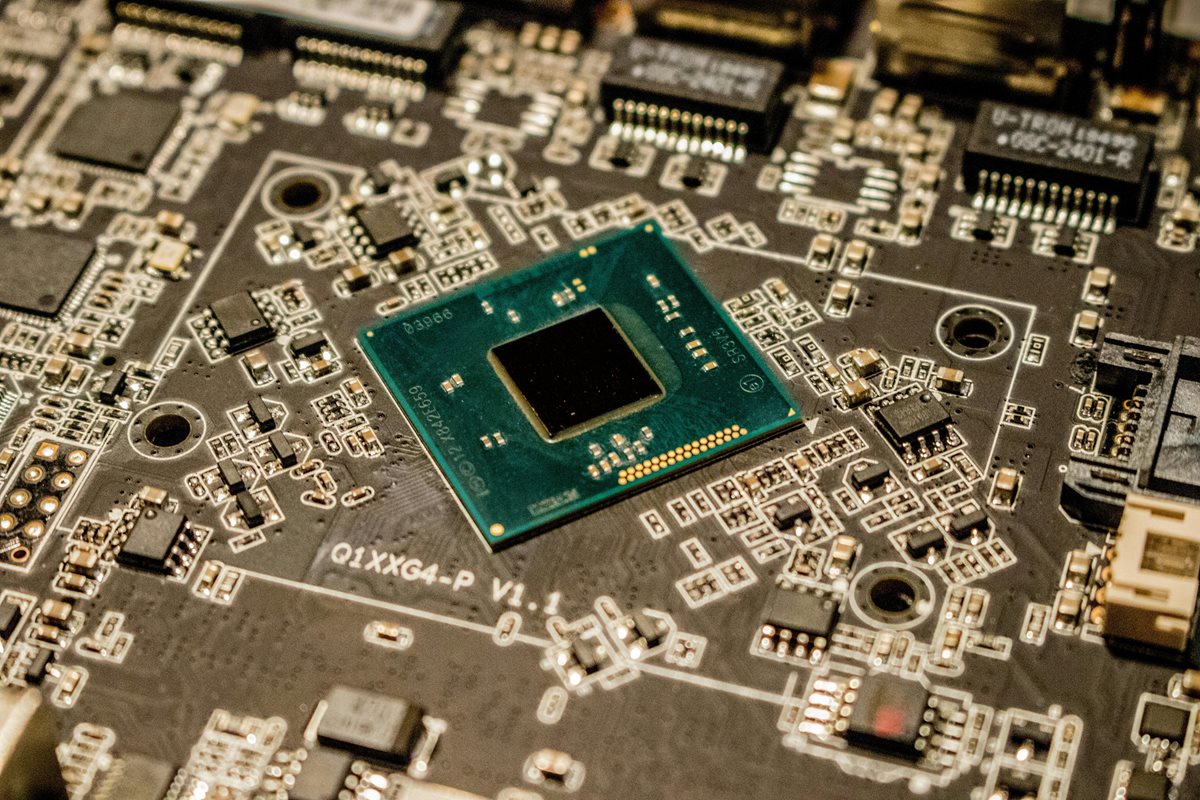

Prasad Satyavolu: Canada’s slow adoption of Manufacturing 4.0 is a significant issue. We’re talking about a transformation that hinges on connected, data-driven operations fueled by AI, robotics, and automation—technologies that can dramatically increase productivity. The U.S. is moving faster with initiatives like the CHIPS Act, which accelerates the adoption of these innovations. Meanwhile, Canada is trailing. This isn’t just a question of inefficiency; it’s about missed opportunities to capitalize on new technologies, optimize manufacturing processes, and stay competitive in a global market that’s rapidly evolving. Every day that goes by without significant action deepens the gap between us and other nations that are embracing these advancements. Canada needs to make bold moves or risk being left behind.

You mentioned the risk of Canada being left behind in a rapidly evolving global market. Do you have any examples of companies that have struggled and what’s the key takeaway for manufacturing?

PS: BlackBerry’s rise and fall is a story Canadians are very familiar with. It’s a striking example of how companies need to stay nimble. Blackberry was once a global leader in smartphone innovation, but when consumer technology shifted rapidly, the company did not recognize fast enough they needed to change as well. We outsourced semiconductor production, a critical technology, to four nations in the Far East. That has set us back 15 years. It’s not just about lost revenue—Canada has lost its ability to innovate domestically, which puts our manufacturing future at risk.

Because we've seen how Canada’s reliance on outsourcing critical technologies has weakened our ability to innovate domestically, could operational silos within manufacturing be worsening this issue?

Sheri Williams: Absolutely that’s what we believe. The fragmentation within Canadian manufacturing is a real problem. Departments like engineering, procurement, and operations are working in isolation. This lack of integration creates a productivity drag. What we’re doing at Accenture Industry X is breaking down those barriers. By connecting these functions into a cohesive system, we’re enabling manufacturers to not only save costs but also achieve faster product cycles and stay competitive globally.

Given these challenges, what’s the biggest risk if Canada doesn’t act quickly?

SW: The biggest risk Canada faces is irrelevance. We’re watching the U.S. take bold, decisive steps toward adopting technologies that will define the future of manufacturing—automation, AI, and digital transformation. If Canada doesn’t act quickly, we’ll lose our competitive edge on the global stage. More than just losing out on innovation, we risk becoming dependent on other nations for critical technologies. We need to confront these challenges and push for the kind of transformation needed to secure Canada’s manufacturing future.

Beyond technology, what other barriers do we need to overcome?

PS: One of the biggest barriers Canada faces is a skills shortage. While there are some good co-op programs and apprenticeships available, they’re simply not enough to meet the demands of modern manufacturing. There’s no cohesive national strategy to upskill the workforce in advanced technologies like AI, robotics, and automation. Without a clear focus on training people for these roles, even the best technology won’t be enough to save the sector. We need a holistic approach that prioritizes both technological adoption and workforce development to close this skills gap.

What’s the takeaway from this discussion as we head into the Symposium?

SW: The solutions are there, but the urgency is real. We need to invest in smarter technologies and, just as importantly, in the people who will use them. Without bold, immediate action, Canada’s manufacturing sector will continue to fall behind, and the gap between us and our global competitors will only widen.

PS: Agreed. It’s about adopting digital tools and building a skilled workforce to regain competitiveness. The Symposium is a platform to start addressing these issues, and I hope it sparks the changes we need.